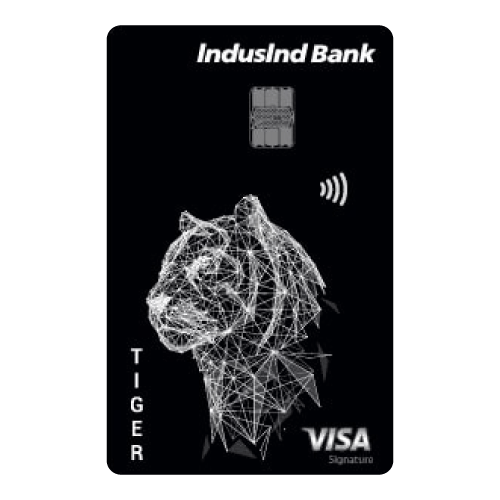

IndusInd Bank Tiger Credit Card: Benefits, Fees & More

- 9 Jan 26

- 4 mins

IndusInd Bank Tiger Credit Card: Benefits, Fees & More

Key Takeaways:

- Get up to 8 domestic airport lounge accesses per year.

- Comes with a forex markup of 1.5% on the transaction value.

- Get 2 international airport lounge accesses per year.

- Offers up to 4 complimentary golf games or lessons per year.

- Get up to 2 BookMyShow movie tickets every year.

If your annual expenses already add up to around ₹6 lakh, it only makes sense to route those payments through a smarter option. With the IndusInd Tiger Credit Card, you can earn savings of over ₹38,000 simply by using the card for spends you would otherwise make in cash.

Instead of letting those transactions go unrewarded, you unlock real cash value through reward redemptions and card benefits.

Explore the benefits, charges and savings breakdown to see how this card can turn everyday spending into meaningful returns.

IndusInd Bank Tiger Credit Card Benefits

Using the Tiger Credit Card by IndusInd Bank, you can earn up to 6 accelerated reward points on every ₹100 spent.

Here are the other benefits of this card:

- You can get a 1.5% discounted forex markup fee.

- Every quarter, you can get 1 complimentary golf game or lesson.

- You can get 2 complimentary domestic airport lounge access per quarter and 2 international airport lounge access per year with Priority Pass.

- The card offers 1 complimentary movie ticket of up to ₹500 on BookMyShow every 6 months.

- You can get a 1% fuel surcharge waiver on fuel transactions between ₹400 and ₹4,000.

- The card offers a Total Protect cover equal to the credit limit for cashless transactions on primary and add-on cards.

IndusInd Bank Tiger Credit Card Fees and Charges

The Tiger Credit Card by IndusInd Bank does not attract any joining fee, annual fee or add-on card fee. However, the other charges applicable to the card are as follows:

| Parameter | Charges |

| Interest Charge | 3.5% per month or 42% per year |

| Over Limit Charge | 2.5% subject to a minimum of ₹500 |

| Cheque Return Charge | ₹250 |

| Cash Advance Charge | 2.5% subject to a minimum of ₹300 |

| Cash Payment at Bank | ₹100 |

| Card Reissuance | ₹100 |

| Charge-slip Request | ₹300 |

| Priority Pass Lounge | Up to US $27 per person per visit |

| Reward Redemption Charge | ₹100 |

| Dynamic Currency Conversion (DCC) | 1% markup |

| Rent Payment Through Third-party Merchants | 1% |

Note: Goods and Services Tax (GST) applies in addition to the above-mentioned charges.

The late payment charge structure of this card is as follows:

| Outstanding Amount | Late Payment Fees |

| Up to ₹100 | Nil |

| ₹101 to ₹500 | ₹100 |

| ₹501 to ₹1,000 | ₹350 |

| ₹1,001 to ₹10,000 | ₹550 |

| ₹10,001 to ₹25,000 | ₹800 |

| ₹25,001 to ₹50,000 | ₹1,100 |

| Above ₹50,000 | ₹1,300 |

To avoid late payment fees, you need to pay your credit card bill on time. You can add your Tiger Credit Card to the Pice app to get bill payment reminders and pay your bill directly from the app.

How to Save with the IndusInd Tiger Credit Card?

Each reward point earned on the IndusInd Tiger Credit Card is valued at ₹0.40. To help you understand how these rewards translate into real savings, here’s a simple illustration:

| Expense/Offer | Value to Customer |

| ₹1,00,000 (reward earning of ₹400) | ₹8,000 |

| ₹1,50,000 (reward earning of ₹1,200) | |

| ₹2,50,000 (reward earning of ₹4,000) | |

| ₹1,00,000 (reward earning of ₹2,400) | |

| 4 complimentary golf games per year at ₹4,000 | ₹16,000 |

| 2 BookMyShow tickets at ₹500 each per year | ₹1,000 |

| 8 Domestic lounge access per year at $14 per visit | ₹10,080 (1 USD = ₹90 assumed) |

| 2 International lounge access per year at $27 per visit | ₹4,860 (1 USD = ₹90 assumed) |

| Total value | ₹39,940 |

By

By